Close to 40,000 students take up CFA in India every year; Here are trends

The Chartered Financial Analyst certification is garnering great relevance among the finance professionals in the last few years. According to official CFA data, the CFA candidates in the last 10 years are approximately the same as the total number of candidates who took the CFA exam from 1963 to 2014. Around 40,000 appear for the three CFA exams every year. Along with the increasing number of CFA candidates, the career scope and salaries of CFA chartholders is also rising. In this article we delve into statistics, how many students appear each year, level wise statistics, pass rate and more.

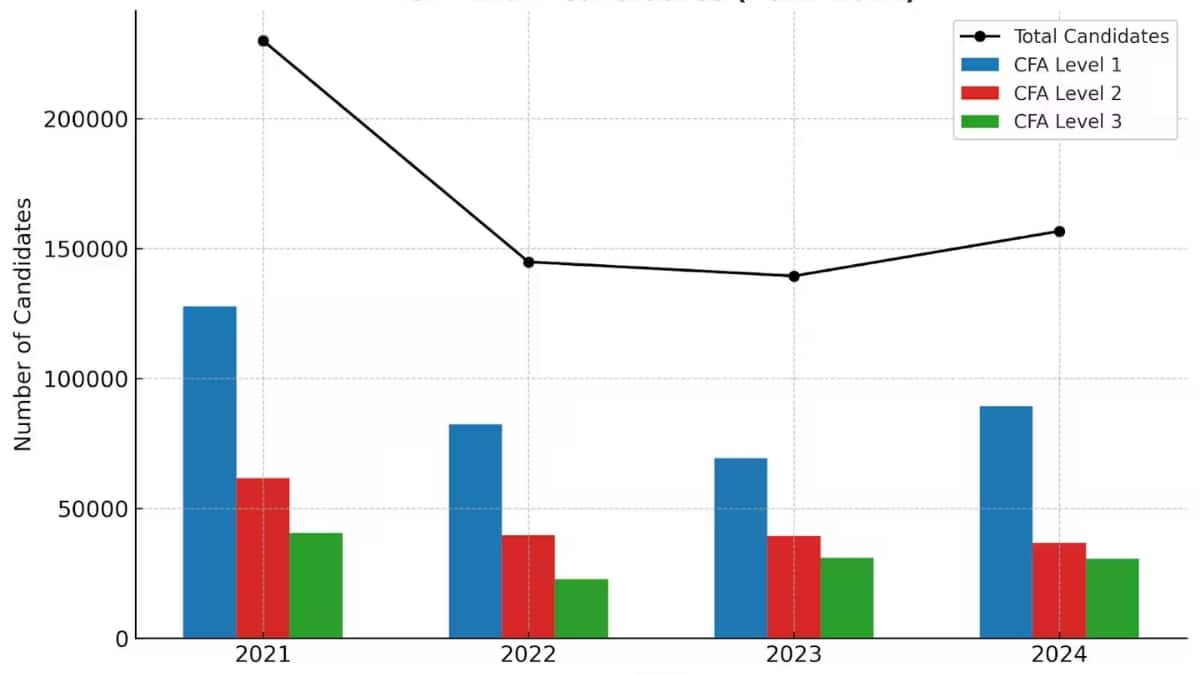

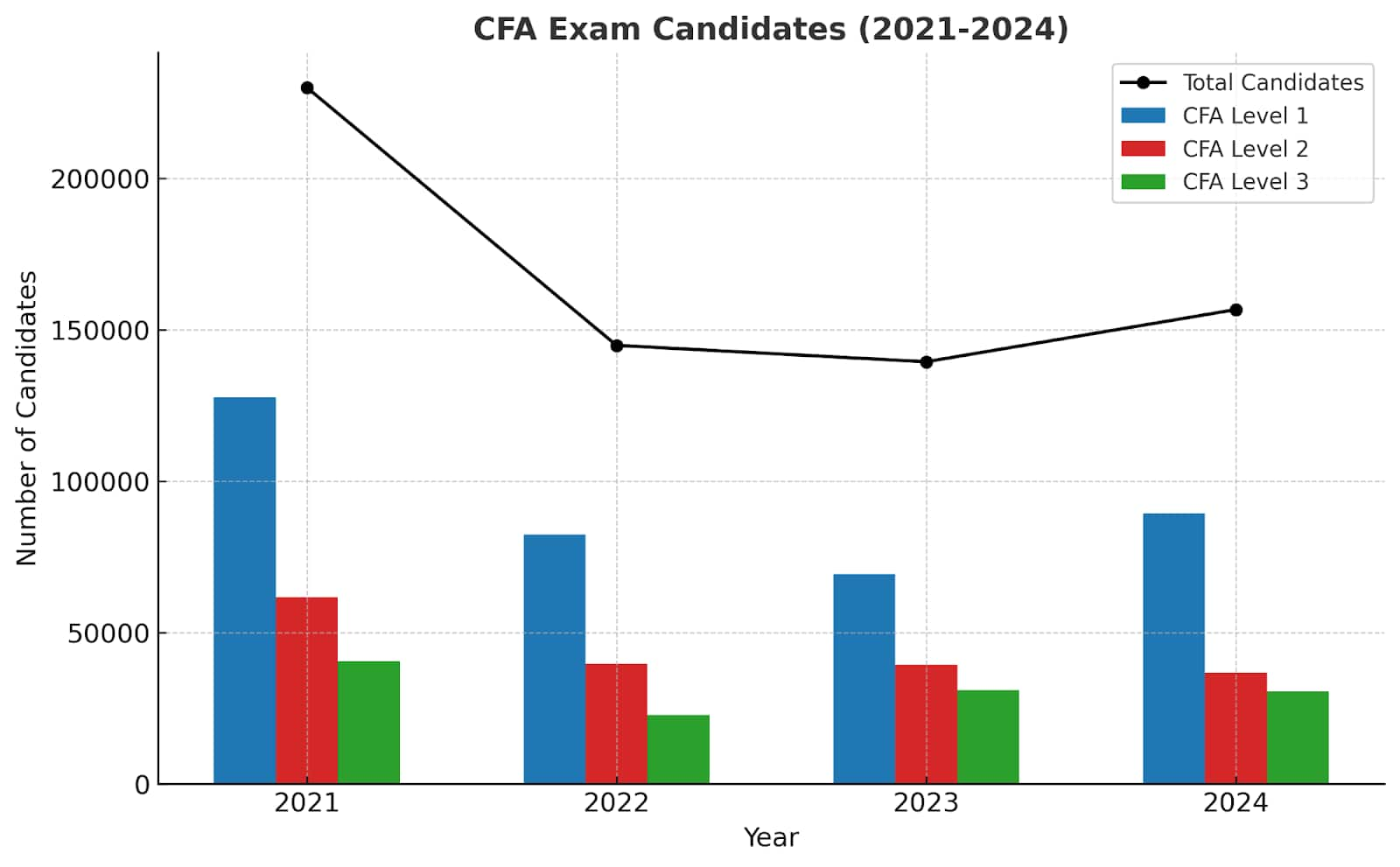

How many students appeared for CFA exams in 2024?

Year | Total Candidates (All Levels) |

2021 | 229,969 |

2022 | 144,815 |

2023 | 139,401 |

2024 | 156,630 |

CFA Candidate Data (2021-2024)

Year | CFA Level 1 Candidates | CFA Level 2 Candidates | CFA Level 3 Candidates |

2021 | 127,733 | 61,678 | 40,558 |

2022 | 82,435 | 39,620 | 22,760 |

2023 | 69,264 | 39,244 | 30,893 |

2024 | 89,389 | 36,675 | 30,566 |

CFA Level 1 Pass Rate Data (Feb 2021 - Nov 2024)

Session | Total Candidates | Passed Candidates | Failed Candidates | Pass Percentage |

February 2021 | 28,683 | 12,510 | 16,173 | 44% |

May 2021 | 26,005 | 6,506 | 19,499 | 25% |

July 2021 | 28,849 | 6,468 | 22,381 | 22% |

August 2021 | 16,026 | 4,211 | 11,815 | 26% |

November 2021 | 28,170 | 7,607 | 20,563 | 27% |

February 2022 | 18,992 | 6,801 | 12,191 | 36% |

May 2022 | 19,403 | 7,315 | 12,088 | 38% |

August 2022 | 19,103 | 7,068 | 12,035 | 37% |

November 2022 | 24,937 | 8,932 | 16,005 | 36% |

February 2023 | 16,959 | 6,441 | 10,518 | 38% |

May 2023 | 23,352 | 9,042 | 14,310 | 39% |

November 2023 | 28,953 | 10,104 | 18,849 | 35% |

February 2024 | 16,932 | 7,415 | 9,517 | 44% |

May 2024 | 21,116 | 9,666 | 11,450 | 46% |

August 2024 | 24,937 | 11,057 | 13,887 | 44% |

November 2024 | 26,404 | 11,293 | 15,111 | 43% |

CFA Level 2 Pass Rate Data (May 2021 - November 2024)

Session | Total Candidates | Passed Candidates | Failed Candidates | Pass Percentage |

May 2021 | 33,066 | 13,300 | 19,766 | 40% |

August 2021 | 10,565 | 3,064 | 7,501 | 29% |

November 2021 | 18,047 | 8,290 | 9,757 | 46% |

February 2022 | 11,699 | 5,132 | 6,567 | 44% |

August 2022 | 15,608 | 6,317 | 9,291 | 40% |

November 2022 | 12,313 | 5,382 | 6,931 | 44% |

May 2023 | 15,585 | 8,291 | 7,604 | 52% |

August 2023 | 9,074 | 3,999 | 5,075 | 44% |

November 2023 | 14,585 | 6,377 | 8,208 | 44% |

May 2024 | 14,304 | 8,386 | 5,918 | 59% |

August 2024 | 8,872 | 4,164 | 4,708 | 47% |

November 2024 | 13,589 | 5,324 | 8,265 | 39% |

CFA Level 3 Pass Rate Data (May 2021 - August 2024)

Session | Total Candidates | Passed Candidates | Failed Candidates | Pass Percentage |

May 2021 | 21,603 | 9,088 | 12,515 | 42% |

August 2021 | 2,769 | 1,091 | 1,678 | 39% |

November 2021 | 16,186 | 6,989 | 9,197 | 43% |

May 2022 | 12,384 | 6,047 | 6,337 | 49% |

August 2022 | 10,376 | 5,032 | 5,344 | 48% |

February 2023 | 14,858 | 7,102 | 7,756 | 48% |

August 2023 | 16,035 | 7,585 | 8,450 | 47% |

February 2024 | 13,619 | 6,734 | 6,885 | 49% |

August 2024 | 16,947 | 8,081 | 8,866 | 48% |

Key Observations and Future Predictions Based on CFA Candidate Data

Here are some notable observations and some predictions for the future sessions:

The year 2021 saw the maximum number of candidates. This is because the exam was conducted more frequently and many candidates were not able to appear for the exam in the previous year due to Covid pandemic.

The year 2024 has shown a stability in the number of candidates appearing for the CFA exam. Overall around 1.5 lakh candidates take the CFA exam every year.

The CFA pass rates are improving over time. The pass rate of CFA has been stable since years, but the recent figures show stabilized improvement.

The highest number of candidates take the CFA Level 1 exam as it is the entrygate to becoming a CFA.

In the future, it is expected that the number of candidates taking CFA exams will increase given its increasing trend and career scope.

Popular Courses and Specializations

Applications for Admissions are open.

Asia’s only university to be awarded the highest accreditation by WASC, USA and by the Quality Assurance Agency for Higher Education (QAA), UK

SRM University, Chennai Science and Humanities PG 2026

ApplyNAAC A++ Accredited | Ranked #11 by NIRF

Amity University-Noida M.Com Admissions 2026

ApplyAmong top 100 Universities Globally in the Times Higher Education (THE) Interdisciplinary Science Rankings 2026

University of Southampton Delhi Masters Admissions 2026

ApplyMSc Finance and MSc International Management Admissions 2026 Now Open | Ranked Among the Top 100 Universities in the World by QS World University Rankings 2025 | Early Round 2 Applications Deadline: 29th Jan’26

IIC Lakshya CPA Course

ApplyAchieve gold standard in accounting & get recognized globally

Somaiya Vidyavihar University B.Com Admissions 2026

ApplyHighest CTC 58 LPA | Avg CTC 11.35 LPA| 150+ Recruiters