Lovely Professional University | B.Com Admissions 2025

India's Largest University | NAAC A++ | 100% Placements Record | Highest CTC 2.5 Cr PA | 150 + Programmes across Multiple Disciplines

The Institute of Company Secretaries has issued the CS Executive December 2025 admit card on December 12, 2025 at its official website, icsi.edu. Candidates can access the CS Executive admit card for December 2025, by entering their 17-digit registration number. The CS Executive Dec 2025 exams will be conducted from December 22 to 29, 2025. Students must carry the physical copy of their hall ticket to the exam centre. Earlier, the deadline to fill out the exam form for CS Executive was October 10, with an additional late fee. The CS Executive December 2025 will be conducted only as per the 2022 syllabus.

The ICSI has notified that candidates who have registered under old syllabus (2017) can now switch to the new CS Executive syllabus (2022) comprising 7 subjects. Candidates should refer to the new syllabus while preparing for the examination.

The second level of the Company Secretary programme is called CS Executive. The first level is CS Foundation/CSEET, whereas, the third and final level is CS Professional programme. ICSI keeps the CS Executive registrations open throughout the year. Candidates who have passed CSEET exams can register for CS Executive Programme. While filling out the exam form, candidates have to select the preferred exam centre for CS Executive exams out of 150+ given exam centres.

| Module | June 2025 | December 2025 |

|---|---|---|

| Single module | January 31, 2025 | July 31, 2025 |

| Both modules | November 30, 2024 | May 31, 2025 |

It should be noted that the Institute of Company Secretaries of India (ICSI) conducts the national-level CS Executive exams in offline mode twice a year: One in June and then again in December.

The below table can be referred to by candidates to get an idea about the release and last dates of CS Executive exam form. Candidates should be registered with the CS Executive programme before a specific date to be eligible to appear for the December 2025 exam.

Particulars | December 2025 |

|---|---|

Deadline for CS Executive registration (both modules) | May 31, 2025 |

Deadline for CS Executive registration (single module) | July 31, 2025 |

Release of exam form | August 26, 2025 |

Last date to fill exam form | September 25, 2025 |

Last date to fill exam form (with late fees) | October 10, 2025 |

Issue of admit card | December 12, 2025 |

CS Executive 2025 exam date | December 22 - 29, 2025 |

CS Executive result 2025 date | Will be notified |

ICSI has divided the CS Executive exam into Module I and Module II. Based on their preference, candidates have the option to appear in either of the modules individually or all together. The CS executive exam (new scheme) consists of a total of 8 papers; whereas, in the old scheme, there are 7 papers.

To qualify CS Executive exam level, candidates need to secure a minimum of 40% marks in each paper and an aggregate of 50% in all papers (single/ both modules).

| Modules | 2022 Syllabus | Sectional cut off | Overall cut off |

|---|---|---|---|

Module 1 | |||

Paper 1 | Jurisprudence, Interpretation and General Laws | 40% | 50% |

Paper 2 | Company Law | 40% | |

Paper 3 | Setting up of Business Entities and Closure | 40% | |

Paper 4 | Tax Laws | 40% | |

Module 2 | |||

Paper 1 | Corporate & Management Accounting | 40% | 50% |

Paper 2 | Securities Laws & Capital Markets | 40% | |

Paper 3 | Economic, Business and Commercial Laws | 40% | |

Paper 4 | Financial and Strategic Management | 40% | |

| Full Exam Name | CS Executive Exam |

| Conducting Body | Institute of Company Secretaries of India |

| Frequency Of Conduct | Twice a year |

| Exam Level | National Level Exam |

| Languages | English |

| Mode Of Application | online |

| Application Fee | Online : 10600 |

| Mode Of Exam | offline |

| Exam Duration | 3 Hours |

CS Executive Exam (session 2026)

The Institute of Company Secretaries of India (ICSI) officially prescribes the eligibility criteria for CS Executive 2025 exams. Details related to the age limit, minimum qualifying marks, education qualification and all are mentioned on the official ICSI website- icsi.edu. Given below eligibility requirements can be checked by candidates-

The Institute of Company Secretaries of India (ICSI) keeps the CS Executive registration open throughout the year. Candidates are advised to check the registration-related cutoff dates to avoid chances of delay/confusion in the registration session. The important cut-off dates as mentioned below.

| Session | Module | Cut off date |

|---|---|---|

| For June Session | For All Modules | November 30 (previous year) |

| For One Module | January 31 (same year) | |

| For December Session | For All Modules | May 31 (same year) |

| For One Module | July 31 (same year) |

Admit card for Class 12 exam

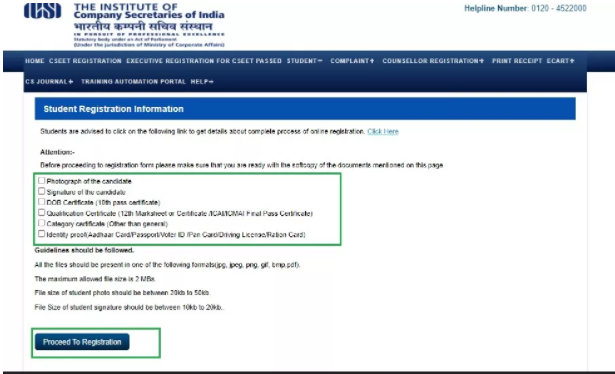

| Particulars | CS Executive Documents Specification |

| File format | jpg, jpeg, png, gif, bmp |

| Small file size | should not exceed 5 MB |

| Small size photo | can be between 20KB – 50KB |

| Signature size | between 10KB – 20K |

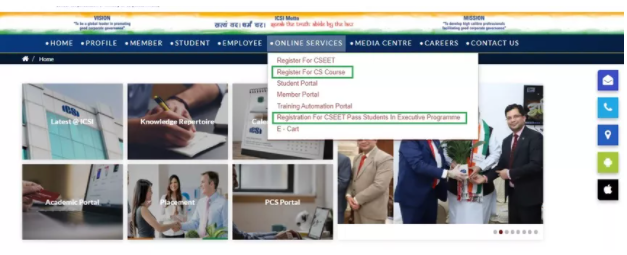

Step 1- Go to the official website of ICSI

Step 2- Click on the option of "Online Services" under the menu bar

Step 3- Now select either of the options "Register for CS course" or "Registration for CSEET passed candidates

Step 4- Proceed to the registration page, enter the required details

Step 5- Upload the scanned copy of all applicable documents; make payment and download the receipt for future reference

Once the registration is complete, it remains valid for 5 years. Post this period, candidates can revalidate their CS Executive registration.

ICSI will open the CS Executive Dec 2025 exam form window in online mode. Candidates who want to appear in the CS Executive exams (either of the modules) have to fill out the exam form starting from August 26 to September 25, 2025. The CS Executive exam form can be filled out in online mode at icsi.edu. While filling out the exam form, candidates could select the module (they wish to appear in), CS Executive exam centre preferences and other related details. The deadline to fill out the exam for CS Executive Dec 2025 session with a late fee is October 10, 2025. The authorities also provide the facility to make certain changes in the already-filled exam form by opening a correction window.

‘Career prospects in Company Secretary’ E-Book which has been structured by ICSI for the students who can learn about how to become a CS and follow path towards a successful career.

Free DownloadDetails related to the mode of exam, total sections, number of questions asked, marking scheme, duration of exam, type of questions asked are mentioned under the CS Executive exam pattern. Before starting the preparation, candidates are advised to go through the official exam pattern. ICSI prescribes the exam pattern on its official website.

| Particulars | Details |

|---|---|

Mode of exam | Offline (Centre based) |

Medium of exam | English and Hindi *English is compulsory for Business Management, Ethics and Communication papers, Tax laws and practice, Cost, Corporate and Management Accounting, Financial and Strategic Management |

Total CS Executive papers | CS Executive new syllabus- 8 papers |

Total exam duration | 3 hours (each paper) |

No. of papers | 100 questions/Paper |

Type of questions | Objective and Subjective |

Subjective based papers in CS Executive syllabus |

|

OMR based papers in CS Executive syllabus |

|

Marking scheme for CS Executive 2023 |

|

Jurisprudence, interpretation, and general laws: Unit 01

Jurisprudence, interpretation, and general laws: Unit 02

Jurisprudence, interpretation, and general laws: Unit 03

Jurisprudence, interpretation, and general laws: Unit 04

Jurisprudence, interpretation, and general laws: Unit 05

Jurisprudence, interpretation, and general laws: Unit 06

Jurisprudence, interpretation, and general laws: Unit 07

Jurisprudence, interpretation, and general laws: Unit 08

Jurisprudence, interpretation, and general laws: Unit 09

Jurisprudence, interpretation, and general laws: Unit 10

Jurisprudence, interpretation, and general laws: Unit 11

Jurisprudence, interpretation, and general laws: Unit 12

Jurisprudence, interpretation, and general laws: Unit 13

Jurisprudence, interpretation, and general laws: Unit 14

Jurisprudence, interpretation, and general laws: Unit 15

Jurisprudence, interpretation, and general laws: Unit 16

Jurisprudence, interpretation, and general laws: Unit 17

Company law: Unit 01

Company law: Unit 02

Company law: Unit 03

Setting up of business entities and closure: Unit 01

Setting up of business entities and closure: Unit 02

Setting up of business entities and closure: Unit 03

Tax laws: Unit 01

Tax laws: Unit 02

Tax laws: Unit 03

Corporate and management accounting: Unit 01

Corporate and management accounting: Unit 02

Securities laws and capital markets: Unit 01

Securities laws and capital markets: Unit 02

Economic, business, and commercial laws: Unit 01

Economic, business, and commercial laws: Unit 02

Economic, business, and commercial laws: Unit 03

Economic, business, and commercial laws: Unit 04

Economic, business, and commercial laws: Unit 05

Economic, business, and commercial laws: Unit 06

Financial and strategic management: Unit 01

Financial and strategic management: Unit 02

For preparatory purposes, candidates can refer to the previous session question papers/ sample papers of CS Executive course. Candidates can solve the questions and get an estimate about the type of questions asked and frame their answering strategy accordingly.

ICSI uploads the official question papers of each session after conducting the exams. Candidates can check the CS Executive question papers 2025 at the official website - icsi.edu.

Candidates preparing for the CS Executive exam should also consider the official CS Executive study material while preparing for the exams. ICSI provides the study material to all registered candidates in both online and offline forms.

The Institute of Company Secretaries of India (ICSI) released the CS Executive Dec 2025 admit card on December 12, 2025 The admit card for CS Executive Dec 2025 will be available online at the official website - icsi.edu.in . Successfully registered candidates can download their admit cards via online mode using the registration number. It is an important document that must be carried out by candidates on exam day.

Click on the online services tab on the home page of icsi.edu

Click on the “student portal” option under the drop-down menu bar and open ‘My Account”

Login to your account by entering “CS Registration number and Password”

Open the “Others” section of your student dashboard.

Download the CS executive admit card 2025

After downloading the admit card; check for the following details -

Candidate’s name, photograph and signature

Exam medium

Exam date and timings

17-digit registration number

Paper-wise exemption (if any)

Name, address and code of CS exam centre

CS Executive module(s) that you have enrolled for

In case of any discrepancy in the information provided, candidates should immediately report the issue to support.icsi.edu.

Contact No.- 0120- 3314111, 0120-6204999

ICSI Support Portal- support.icsi.edu

The CS Executive result for June 2025 session will be announced tentatively 45 days after the conclusion of exams. Candidates can check their results using their CS registration number and roll number.

Step 1- Visit the official website of ICSI i.e. icsi.edu

Step 2- Click on the "result link" and select old/new CS executive examination from the drop-down menu

Step 3- Enter your Roll No. and Registration ID and proceed to check the result

Step 4- The mark sheet of CS Executive 2025 will appear

Step 5- Download and take a printout of the e-result for future reference

In order to proceed to the CS Professional level, candidates need to qualify for both the modules of CS Executive level. It is mandatory to secure a minimum of 40% marks in each paper and 50% marks in aggregate. Candidates who do not meet the minimum qualifying criteria of ICSI have to re-appear in that exam/ module (as the case may be).

Along with the result, ICSI also releases the merit list and pass percentage of the CS Executive course. Candidates can check the pass percentage of previous sessions below.

CS Executive Session | Pass Percentage -2017 | Pass Percentage - 2022 Syllabus |

| December 2023 |

|

|

| June 2023 | - |

|

| December 2022 | - |

|

| June 2022 | - |

|

| December 2021 |

|

|

June 2021 |

|

|

December 2020 |

|

|

June 2020 |

|

|

Contact Number:

0120-4522000

Relevant Links:

Official Website Link Click HereIndia's Largest University | NAAC A++ | 100% Placements Record | Highest CTC 2.5 Cr PA | 150 + Programmes across Multiple Disciplines

NAAC A+ Accredited | Among top 2% Universities Globally (QS World University Rankings 2026)

Frequently Asked Questions (FAQs)

ICSI will conduct CS Executive December 2025 exam from December 22 to 29, 2025.

There are a total of 8 papers in the CS Executive new syllabus.

Yes, candidates have the option of appear in either of the module. If you want to appear in only one module (I or II) select the same while filling the CS Executive exam form. Candidates who wish to appear in both modules in same session can also do that. The exam form fee varies in both cases.

Once you have qualified both the modules of CS Executive course, you can register for the CS Professional exam.

CS Executive is the second level of exams to become a Company Secretary. It is conducted by The Institute of Company Secretaries of India (ICSI).

CS Executive registration is valid for five years. Post this, candidates have to revalidate their registration.

Candidates who wish to appear in the exam need to pay the exam form fee as follows-

Particulars | Fee amount |

Module I of CS Executive | Rs 1200 |

Module II of CS Executive 2022 | Rs 1200 |

Both Modules of CS Executive | Rs 2400 |

As per the eligibility criteria, candidates who are graduate/ postgraduate can register for the CS Executive course. Such candidates do not need to register for the first stage i.e. CSEET.

The revised Fee Structure for registration to Executive Programme is as follows-

Only CSEET passed candidates can submit their Class 10+2 mark sheet within six months from the date of Executive Programme Registration.

On Question asked by student community

Hello Saniya,

if you can read the module in one go and can revise the same Atleast 3 to 4times from august month to December then you should definatelly go for it.

But if you are having a doubt in mind if you cant clear CSEET or Cs group 1

Hello Aspirant,Hope you are doing well

If student fails to fill the exam form of CS Executive then that particular student is not allowed to write the exam as filling a form is an essential requirement.That student can write the exam only in next term after filling the form.

Hope

Hello there,

Yes , you are eligible for CS Executive exam .

Here is the Eligibility criteria for CS Executive Eligibility Criteria :-

As per the eligibility criteria candidate must have completed their graduation / post graduation can registered for the CS Executive course.

As per CS Executive eligibility criteria

Asia’s only university to be awarded the highest accreditation by WASC, USA and by the Quality Assurance Agency for Higher Education (QAA), UK

NAAC A++ Accredited | Ranked #11 by NIRF

Among top 100 Universities Globally in the Times Higher Education (THE) Interdisciplinary Science Rankings 2026

MSc Finance and MSc International Management Admissions 2026 Now Open | Ranked Among the Top 100 Universities in the World by QS World University Rankings 2025 | Early Round 2 Applications Deadline: 29th Jan’26

Achieve gold standard in accounting & get recognized globally

Highest CTC 58 LPA | Avg CTC 11.35 LPA| 150+ Recruiters