CFA Level 3 Registration 2025 (Open for August) - Fees, Last Date, Eligibility

The Chartered Financial Analyst (CFA) Institute has opened the CFA Level 3 August 2025 registration on November 6, 2024. The deadline to register for CFA level 3 August 2025 is May 6, 2025. Candidates can apply from the official website - cfainstitute.org. The entire registration process is online. The upcoming CFA level 3 February 2025 will be conducted from February 13-16, 2025. The CFA level 3 August 2025 exams will be conducted from August 15-19, 2025. The institute earlier closed CFA level 3 February 2025 registrations on November 7, 2024.

This Story also Contains

- CFA Level 3 Eligibility Criteria 2025

- Process of CFA Level 3 Registration 2025

- CFA Level 3 Registration Fee 2025

- CFA Level 3 Exam Centres 2025

- What after CFA level 3 registration?

The CFA exams for level 3 are conducted in two sessions per year - February and August. Read ahead to get all the information on the process of CFA level 3 registration 2024, eligibility criteria, exam centres, and much more.

CFA Level 3 Exam Dates 2025

| Events | February 2025 | August 2025 |

|---|---|---|

Registration Window Opens | May 9, 2024 | November 6, 2024 |

Scheduling Window Opens | May 9, 2024 | November 6, 2024 |

Early Registration Deadline | July 9, 2024 | January 29, 2025 |

| Invoice Payment Deadline | September 28, 2024 | March 27, 2025 |

Registration Closes on | November 7, 2024 | May 6, 2025 |

Scheduling Last Date | November 12, 2024 | May 13, 2025 |

Rescheduling deadline for CFA Level 3 exam | January 18, 2024 | July 14, 2025 |

| February 13 - February 16, 2025 | August 15 to 19, 2025 | |

CFA Level 3 Result Date | TBA | TBA |

CFA Level 3 Eligibility Criteria 2025

Before filling the application form of The Chartered Financial Analyst Institute, candidates should carefully go through the eligibility requirements to avoid the future rejections of application form. Details related to the educational qualification, age limit, minimum qualifying marks are provided under the eligibility criteria of CFA level 3.

As per the eligibility requirement, candidates should have completed their graduation. They should also have cleared previous CFA exams - CFA Level 1 exam and CFA Level 2 exam. Candidates must also have at least a minimum of 4000 hours of work experience and/or 3 sequential years of higher education.

Process of CFA Level 3 Registration 2025

Candidates can follow the given steps to register for the CFA Level 3 exam. CFA level 3 registrations are open throughout the year. Candidates must track the registration dates for the sessions for which they wish to apply.

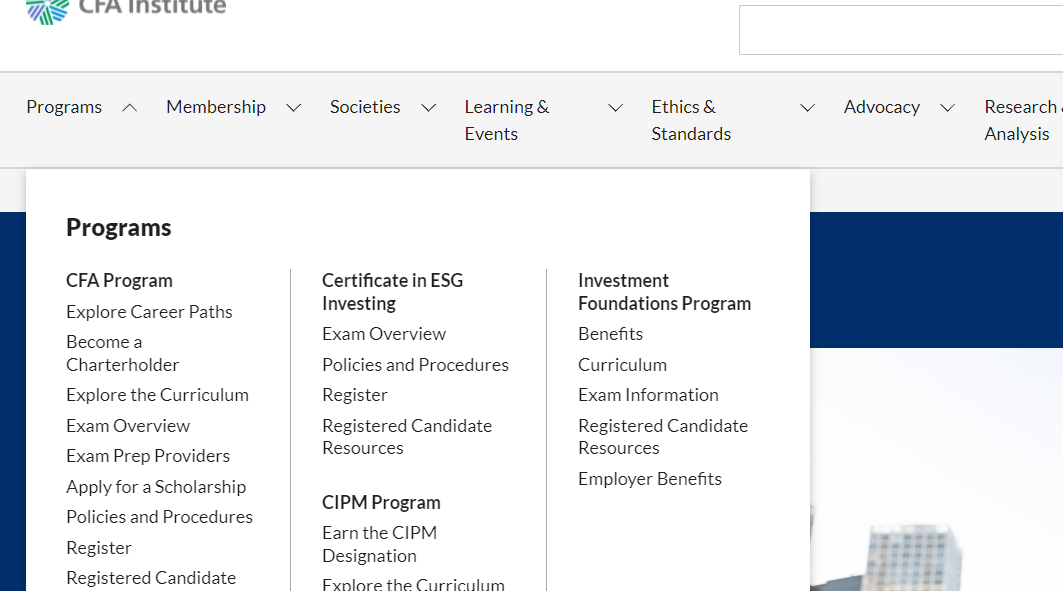

Step 1 - Go to the official website of the CFA Institute - cfainstitute.org and click on "Programs" given on the menu bar. Now, select the option “Register” under the drop down menu to proceed further as shown in the image.

Step 2 - You will be redirected to the page shown in the image below. Now scroll down and click on the link “Enroll and Register” to proceed further for the CFA Level 3 registration.

Step 3 - Sign in to your existing CFA account by entering your registered email address. Now choose CFA level 3 to register. Enter the required details, fill address details and choose the CFA level 3 exam centre as per your preference.

Fill other details such as - passport number, status of employment as per experience, provide your work history. Once done, read all the policies mentioned on the official website of CFA. Check the statement of understanding to move further.

Step 4 - Make the payment as per the CFA level 3 fee guidelines through any of the payment modes given by the institute.

CFA Level 3 Registration Fee 2025

To complete the process of registration, candidates have to make payment of the CFA level 3 registration fee. The time at which the registration for CFA Level 3 Exam 2025 is done also impacts the registration fee. Given below is the registration fee for CFA Level 3-

CFA level 3 Fee

| Stages | February 2025 | August 2025 |

|---|---|---|

Early Registration Fee | USD 1090 | USD 1090 |

Standard Registration Fee | USD 1390 | USD 1390 |

| Rescheduling fee | USD 250 | USD 250 |

CFA Level 3 Exam Centres 2025

The Chartered Financial Analyst Institute will conduct computer-based exams in over 400 centers around the globe. In India, there are 23 designated CFA exam centres. Candidates will be able to select the final test centers with confirmed available seating during the CFA level 3 scheduling process.

What after CFA level 3 registration?

Once the registration for CFA level 3 exams is over, The Chartered Financial Analyst Institute will release the CFA level 3 admission ticket 2025 in online mode. All candidates must download the admit card before appearing in the CFA level 3 exam. Candidates who live in no network zone or are unable to download their admit cards can request for a fax copy from the institute.

Frequently Asked Questions (FAQs)

As per the exam dates, candidates can register for the August 2025 session exam till May 6, 2025.

Given below is the fee range of CFA level 3 registration-

Early Registration Fee: USD 1090

Standard Registration Fee: USD 1390

No, CFA level 3 registration can be done only in online mode.

The CFA Level 3 exam is conducted twice a year - February and August.

Popular Courses and Specializations

Applications for Admissions are open.

Asia’s only university to be awarded the highest accreditation by WASC, USA and by the Quality Assurance Agency for Higher Education (QAA), UK

SRM University, Chennai Science and Humanities PG 2026

ApplyNAAC A++ Accredited | Ranked #11 by NIRF

Amity University-Noida M.Com Admissions 2026

ApplyAmong top 100 Universities Globally in the Times Higher Education (THE) Interdisciplinary Science Rankings 2026

University of Southampton Delhi Masters Admissions 2026

ApplyMSc Finance and MSc International Management Admissions 2026 Now Open | Ranked Among the Top 100 Universities in the World by QS World University Rankings 2025 | Early Round 2 Applications Deadline: 29th Jan’26

IIC Lakshya CPA Course

ApplyAchieve gold standard in accounting & get recognized globally

Somaiya Vidyavihar University B.Com Admissions 2026

ApplyHighest CTC 58 LPA | Avg CTC 11.35 LPA| 150+ Recruiters