Yes, you can get a scholarship for CA Intermediate if you qualify for certain programs. The ICAI itself offers merit-based and need-based scholarships to help students. You can also apply through the National Scholarship Portal if your family income fits the criteria. Many private organizations like the Sahu Jain

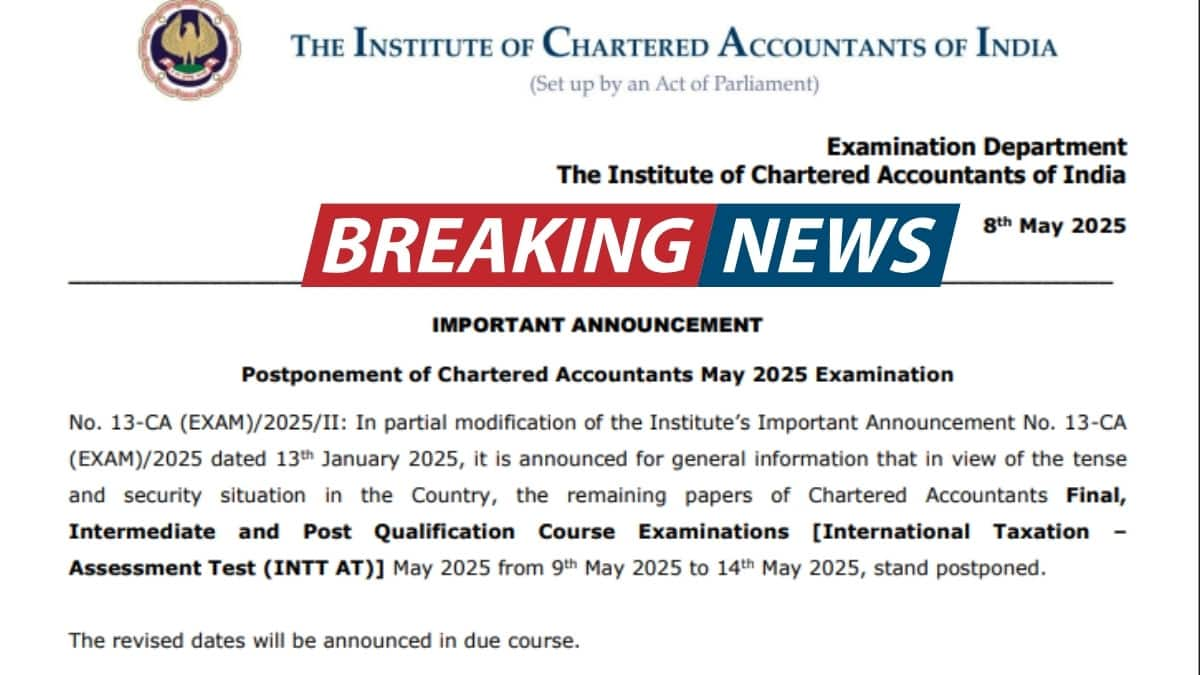

ICAI CA Inter and Final May 2025 Exams Postponed due to security reasons, new exam dates soon

The Institute of Chartered Accountants of India has postponed the CA Final, Intermediate and Post Qualification Course Examinations [International Taxation – Assessment Test (INTT AT)] May 2025 scheduled between 9th May 2025 and 14th May 2025. Earlier, ICAI postponed the CA May 2025 exam in 12 cities, including Chandigarh, Bhuj, Jammu, Srinagar, Amritsar, Bathinda, Jalandhar, Ludhiana, Pathankot, Bikaner, Jodhpur, and Sri Ganganagar. However, as per the latest notification, this decision has now been extended to the entire country due to the rising tensions between India and Pakistan.

According to the previous exam schedule, CA Intermediate May 2025 Group 1 exams were set for May 3, 5, and 7. Group 2 exams were planned for May 9, 11, and 14. Similarly, May 2, 4, and 6 were allocated for CA Final Group 1 exams, while Group 2 exams were scheduled for May 8, 10, and 13. ICAI has announced that the revised CA Inter and Final May 2025 exam dates will be notified in due course. The CA Foundation exam dates for May 2025 remain unaffected.

CA Intermediate May 2025 Exam Dates

The CA Intermediate May 2025 exam dates have been released, with exams starting from May 3. The CA Inter papers 4, 5, and 6 have been postponed due to the current national situation.

CA Inter Exam Dates May 2025

Paper(s) | Exam Dates | Exam Timings |

Paper 1: Advanced Accounting | May 3, 2025 | 2 pm to 5 pm |

Paper 2: Corporate and Other Laws | May 5, 2025 | 2 pm to 5 pm |

Paper 3: Taxation | May 7, 2025 | 2 pm to 5 pm |

Paper 4: Cost and Management Accounting | May 9, 2025 (Postponed) | 2 pm to 5 pm |

Paper 5: Auditing and Ethics | May 11, 2025 (Postponed) | 2 pm to 5 pm |

Paper 6: Financial Management and Strategic Management | May 14, 2025 (Postponed) | 2 pm to 5 pm |

CA Final Exam Dates May 2025

The CA Final May 2025 exam dates were officially released. However, the CA Final papers 5 and 6 have been postponed due to the ongoing tension between India and Pakistan.

CA Final May 2025 Exam Dates

Groups | Papers | Exam Dates | Timings |

Group I | Paper - 1 : Financial Reporting | May 2, 2025 | 2 PM - 5 PM |

Paper - 2 : Advanced Financial Management | May 4, 2025 | 2 PM - 5 PM | |

Paper - 3 : Advanced Auditing, Assurance And Professional Ethics | May 6, 2025 | 2 PM - 5 PM | |

Group II | Paper – 4 : Direct Tax Laws and International Taxation | May 8, 2025 | 2 PM - 5 PM |

Paper – 5 : Indirect Tax Laws | May 10, 2025 (Postponed) | 2 PM - 5 PM | |

Paper – 6: Integrated Business Solutions (Multi-Disciplinary Case Study With Strategic Management) | May 13, 2025 (Postponed) | 2 PM - 6 PM |

Popular Courses and Specializations

Questions related to CA Intermediate Exam

On Question asked by student community

Hello aspirant,

Here is your CA Intermediate Previous Year Question Papers. kindly open the link and check it out

https://finance.careers360.com/articles/ca-intermediate-previous-year-question-papers

Thanku you

Hello,

CMA or Cost and Management Accounting is a certificate course providing CMA designation to the qualifiers. CMA has both descriptive and objective questions. CMA foundation is a mixture of questions. It is a three hour long exam conducted by ICMAI and it is a paper based on mainly class

Hello Aspirant,

Hope you are doing great. A common course that covers accounting, taxation, financial analysis, and financial economics is called chartered accountancy, or CA. The three-level CA course offered in India is in high demand both domestically and internationally. Delhi, Bangalore, Mumbai, and Ahmedabad are a few of the

Hi,

For being eligible for the direct entry route in CA i.e for giving CA Intermediate exam directly without apppearing for the CA foundation exam you need to atleast complete your graduation. Since you have just completed your second semester exam you are not eligible for the direct entry route

Applications for Admissions are open.

Asia’s only university to be awarded the highest accreditation by WASC, USA and by the Quality Assurance Agency for Higher Education (QAA), UK

SRM University, Chennai Science and Humanities PG 2026

ApplyNAAC A++ Accredited | Ranked #11 by NIRF

Amity University-Noida M.Com Admissions 2026

ApplyAmong top 100 Universities Globally in the Times Higher Education (THE) Interdisciplinary Science Rankings 2026

University of Southampton Delhi Masters Admissions 2026

ApplyMSc Finance and MSc International Management Admissions 2026 Now Open | Ranked Among the Top 100 Universities in the World by QS World University Rankings 2025 | Early Round 2 Applications Deadline: 29th Jan’26

IIC Lakshya CPA Course

ApplyAchieve gold standard in accounting & get recognized globally

Somaiya Vidyavihar University B.Com Admissions 2026

ApplyHighest CTC 58 LPA | Avg CTC 11.35 LPA| 150+ Recruiters