UPES Dehradun | B.Com Admissions 2026

Last Date to Apply: 25th Feb | Ranked #45 Among Universities in India by NIRF | 1950+ Students Placed 91% Placement, 800+ Recruiters

ICAI New Scheme of Education and Training: Chartered Accountancy or CA is a highly sought after career option. It is financially lucrative and at the same time difficult to crack. Any new candidate who wants to become a Chartered Accountant should note that the Institute of Cost Accountants of India (ICAI) has released a new scheme of education and training for CA which has become effective from July 1, 2023. The first exam under the new scheme was conducted in May 2024. The ICAI new scheme of education and training is being followed since that session and the old scheme has been discontinued. The ICAI new syllabus is applicable for all the three levels of the CA exam - CA Foundation, CA Intermediate and CA Final. Details about the new CA syllabus were announced on July 1, 2023. Read the complete article to know about the ICAI new scheme of education and the path to become a CA.

The ICAI has devised a CA Final new scheme and CA Inter new scheme to streamline the CA course as per the New Education Policy, 2020 (NEP) and international education standards. ICAI’s new scheme was notified on 22nd June, 2023 in the Gazette of India impacting anyone who wants to pursue the dream of becoming a CA. The upcoming CA May 2025 exams will be conducted as per the ICAI new scheme of education and training.

Given below is a table that provides an overview of the difference between the ICAI new scheme and old scheme.

Activity | Current Scheme | New scheme |

|---|---|---|

Registration for Foundation / appear for 10+2 | After Class 10 | After Class 10 |

Appear for Foundation Examination | After 4 months study period | After 4 months study period |

Study for Intermediate Examination | 8 months | 8 months |

Articleship | 36 month | 24 months |

Study for Final Examination | - | 6 months |

Total period to become ICAI member | 48 months | 42 months |

Business Accounting Certificate (Optional) | - | After clearing CA Inter and self paced learning modules and completion of PT and Integrated Course on Information Technology and Soft Skills |

Given below are important dates for the implementation of the new education scheme of ICAI

Last date for Registering for Foundation course under Existing Scheme | July 1, 2023 |

Last date for Registering for Intermediate and Final Courses under Existing Scheme | June 30, 2023 |

Date of commencement of Registration and Conversion in Foundation Course under the New Scheme | August 2, 2023 |

Date of commencement of Registration and Conversion in Intermediate and Final Courses under New Scheme | July 1, 2023 |

First Foundation Exam under CA Foundation new scheme | June, 2024 |

First Intermediate and Final Exam under New Scheme | May, 2024 |

Last Foundation Examination under Existing Scheme | December, 2023 |

Last Intermediate and Final Examination under Existing Scheme | November, 2023 |

Last date of commencement of three years Practical Training | June 30, 2023 |

Date of commencement of two years uninterrupted Practical Training | July 1, 2023 |

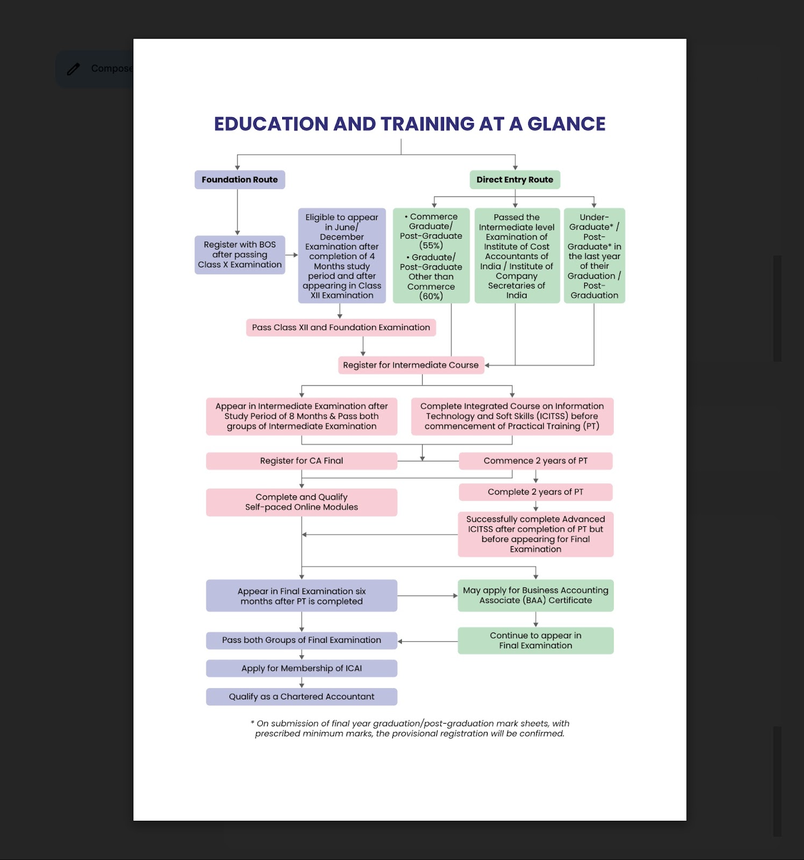

The new ICAI scheme lays out the steps to becoming a CA. The CA course consists of three levels namely.

CA Foundation level,

CA Intermediate level

CA Final

Last Date to Apply: 25th Feb | Ranked #45 Among Universities in India by NIRF | 1950+ Students Placed 91% Placement, 800+ Recruiters

B.Sc (Hons) Admissions 2026 Now Open | Ranked Among the Top 100 Universities in the World by QS World University Rankings 2025 | Early Round 2 Applications Deadline: 29th Jan’26

There are two ways to become eligible for the CA Intermediate course

One is by completing the CA foundation course

The other is through the direct route.

Candidates who have completed 12th grade can register themselves for the CA Foundation exam. On the other hand, graduates can directly register themselves for the CA Intermediate level. The intermediate course is referred to as the study course of Chartered Accountancy.

Let’s look at the eligibility criteria and other details for each level of the ICAI new course that will act as a reference guide to become a CA.

A candidate should register with the Board of Studies in order to register for the CA course. One can do so after clearing the 10th Std examination. However, in order to appear for the CA foundation course, a candidate must have completed 4 months of study period and also appeared for the 12th std examination. The candidates will then become eligible to appear for the January, May or September of the CA foundation exam.

ICAI has notified the new syllabus for CA Foundation course on July, 1 2023.

The new syllabus has the following papers:

| Paper 1 | Accounting |

| Paper 2 | Business Laws |

| Paper 3 | Quantitative Aptitude Part A: Business Mathematics Part B: Logical Reasoning Part C: Statistics |

| Paper 4 | Business Economics |

India's youngest NAAC A++ accredited University | NIRF rank band 151-200 | 2200 Recruiters | 45.98 Lakhs Highest Package

India's Largest University | NAAC A++ | 100% Placements Record | Highest CTC 2.5 Cr PA | 150 + Programmes across Multiple Disciplines

The old syllabus of CA foundation exam consists of four papers

Paper 1 | Principles and Practice of Accounting |

Paper 2 | Business Laws and Business Correspondence and Reporting |

Paper 3 | Business Mathematics, Logical Reasoning and Statistics |

Paper 4 | Business Economics and Business and Commercial Knowledge |

Once candidates clear the 12th examination and the foundation exam, they become eligible to register for the intermediate course. As per the new scheme, to clear the CA Foundation exam a candidate must score a minimum 40% marks in each paper and an aggregate of 50% in all four papers

Direct Route

Another route to become eligible for registration for the intermediate course is the direct route which one can opt after graduation or after clearing the Intermediate level exam of the Institute of Cost Accountants of India or Institute of Company Secretaries of India.

Direct Entry Route Eligibility Overview

1. | Commerce Graduate/ Post-Graduate with minimum of 55% marks. Graduate/ Post-Graduate Other than Commerce with minimum of 60% marks |

2. | Passed the Intermediate level Examination of Institute of Cost Accountants of India / Institute of Company Secretaries of India |

3. | Under- Graduate / Post- Graduate in the last year of their Graduation / Post- Graduation can also apply provided that they produce their qualifying certificate with the prescribed minimum marks before registering to appear for the CA Intermediate exam. |

The second step in the CA exam is the CA Inter program.

As per the new CA intermediate syllabus released on July 1, 2023 by ICAI, the following 6 papers are included in it

| Paper 1 | Advanced Accounting |

| Paper 2 | Corporate and Other Laws Part 1: Company Law and Limited Liability Partnership Law Part 2: Other Laws |

| Paper 3 | Taxation Section A: Income Tax Law Section B: Goods and Services Tax |

| Paper 4 | Cost and Management Accounting |

| Paper 5 | Auditing and Ethics |

| Paper 6 | Financial Management and Strategic Management Section A: Financial Management Section B: Strategic Management |

The old Intermediate exam syllabus of CA comprised of eight papers divided into two groups

Group 1 | Group 2 |

Paper 1: Accounting | Paper 5: Advanced Accounting |

Paper 2: Corporate and Other Laws | Paper 6: Auditing and Assurance |

Paper 3: Cost and Management Accounting | Paper 7: Enterprise Information Systems and Strategic Management |

Paper 4: Taxation | Paper 8: Financial Management and Economics for Finance |

The new CA scheme specifies that candidates can appear for the CA Intermediate Exam if they satisfy the following requirements:

Candidates have to register themselves with the Board of Studies. Candidates who joined through the CA Foundation route are already registered with BoS so they can skip this condition

Candidates have to complete a study period of 8 months and produce a certificate in that regard as stipulated by the ICAI council.

On fulfilment of the above conditions, a candidate can appear for the exam. The registration for the intermediate course is valid for a period of 10 years after which the candidate needs to revalidate the registration for another period of 10 years. Presently, the CA Intermediate exam is held thrice a year - January, May and September.

The candidate would have passed the CA Intermediate exam on fulfilling the conditions mentioned below:

Candidate clears all the papers from Group 1 and Group 2 in one sitting with a minimum score of 40% in each of the papers and 50% in aggregate of all the papers.

Also Read: CPA Salary in India - Job Opportunities, Roles & Responsibilities

Once candidates clear the second level of the CA course, they can register for the CA final level.

Before appearing for the CA Final exam, candidates have to fulfil the following conditions.

Complete Integrated Course on Information Technology and Soft Skills (ICITSS) after registration for Intermediate course but before commencement of Practical Training (PT)

Undergo a practical training (PT) of two years as per Regulation 50 of the Chartered Accountants (Amendment) Regulations, 2023. Earlier this training period was of three years which has been reduced under the new scheme.

After completion of the practical training but before appearing for the CA final examination, candidates also have to undergo an Advanced Integrated Course on Information Technology and Soft Skills for such duration as specified by the ICAI Council.

Also, a candidate needs to complete the self-paced online learning modules with a minimum of 50% marks after completing the CA Intermediate exam but before appearing for the CA Final exam.

The self paced learning modules consists of the following.

| Sets | Paper Name |

| Set A (Compulsory) | Corporate and Economic Laws |

| Set B (Compulsory) | Strategic Cost and Performance Management |

| Set C (Any One) | Risk Management Sustainable Development & Sustainability Reporting Public Finance & Government Accounting The Insolvency and Bankruptcy Code, 2016 International Taxation The Arbitration and Conciliation Act, 1996 Forensic Accounting Valuation Financial Service and Capital Markets Forex and Treasury Management |

| Set D (AnyOne) | The Constitution of India and Art of Advocacy Psychology and Philosophy Entrepreneurship and Start Up Ecosystem Digital Ecosystem and Controls |

Candidates can appear in the CA Final exam six months after completion of the Practical Training. Presently, the CA Final exam is held twice a year - May/June and November/December.

As per the new syllabus notified on July 1, 2023 the new CA Final syllabus comprises of the following papers:

| Paper 1 | Financial Reporting |

| Paper 2 | Advanced Financial Management |

| Paper 3 | Advanced Auditing, Assurance and Professional Ethics |

| Paper 4 | Direct Tax Laws and International Taxation |

| Paper 5 | Indirect Tax Laws: Part I: Goods and Services Tax Part II: Customs and FTP |

The old syllabus of the CA Final exam consisted of the following papers:

Paper 1- Financial Accounting | Paper 6C- International Taxation |

Paper 2- Strategic Financial Management | Paper 6 D- Economic laws (100 Marks) |

Paper 3- Advanced Auditing and Professional Ethics | Paper 6E- Global Financial Reporting Standards |

Paper 4- Corporate and Economic Laws | Paper 6F- Multidisciplinary Case Study |

Paper 5- Strategic Cost Management and Performance Evaluation | Paper 7- Direct Tax laws and International taxation |

Paper 6A- Risk Management | Paper 8- Indirect Tax Laws |

Paper 6 B- Financial Services and Capital Markets |

Once the candidate clears all the papers with a minimum of 40% marks in individual papers and scores 50% in aggregate, they will be said to have passed the CA Final examination. They can apply for membership with the Institute of Chartered Accountants of India and qualify to become a Chartered Accountant.

Additionally, before appearing for the CA Final exam, a candidate can also apply for a Business Accounting Certificate (BAC) if they meet the following conditions:

Clear both Group 1 and Group 2 exams of the CA Inter level

Complete the Integrated Course on Information Technology and Soft Skills

Completes the practical training as laid down in the CA regulations

Completes the self paced learning modules

Upon earning the certificate, the candidate can proceed to appear for the CA Final exam.

Frequently Asked Questions (FAQs)

The ICAI new scheme of education has come into effect from July 1, 2023.

A commerce graduate with minimum 55% marks or a graduate in other streams with minimum 60% marks can join the CA Inter level.To join the CA foundation course a candidate should complete 12th grade.

Yes. One can join the CA foundation course after 12th grade by registering with the Board of Studies.

There are three steps. One needs to complete the Foundation, Intermediate and Final levels of the CA exam.

On Question asked by student community

Hello,

If you’ve given the CA Foundation exam three times and still couldn’t clear it, don’t worry, there are many good alternatives you can go for. Here are some options you can consider:

B.Com (Bachelor of Commerce):

You can continue your studies with B.Com. It gives you a strong base

Hello aspirant,

Under the proposed plan, Module 1 of the CA Foundation Accounting syllabus for 2025 covers theoretical frameworks, fundamental accounting procedures, bank reconciliation, and inventory. Final accounts for partnerships, companies, and sole proprietors as well as non-profit organizations are included in Module 2. Depreciation, bills of exchange, and specific

Hello aspirant,

The CA Foundation September 2025 exam has been completed by the Institute of Chartered Accountants of India (ICAI). Candidates are anxiously awaiting their CA Foundation Sep 2025 results after the exam is over. The CA Foundation results are anticipated to be released by ICAI in September 2025, most

Hello CA student,

You can download the admit card even through SSP.

The ICAI has already issued the admit card for September 2025 exams.

All the best.

Hello aspirant,

Students must register with BoS by September 1, 2024, and finish the four-month study session. Additionally, provisional registrations for students who passed their tenth class have begun at ICAI.

For more information you can visit our site by clicking on the link given below.

Thank you

Among top 100 Universities Globally in the Times Higher Education (THE) Interdisciplinary Science Rankings 2026

100% Placements Assistance | 1200+ Recruiters

High-quality global education at an affordable cost. International exchange programs & collaborations

Awarded as the most Promising brand | Meritorious Scholarship available

#14 in India by NIRF Ranking | Institution of Eminence by Govt. of India | Scholarships Available | Highest CTC 1 Crore

NAAC A+ Accredited | Among top 2% Universities Globally (QS World University Rankings 2026)